Income Tax Refund awaited

Income Tax Refund awaited ? This article provides detail guide on Income Tax Refund tracking, how to make refund reissue request, things to do for receiving fast income tax refund and mode of refund payment.

Once the assessee has filed his/her income tax return and verified the same, income tax refund if any refundable to assessee will be issued to him usually within a month after his income tax return is processed with refund and intimation u/s 143(1) has been received.

The disbursement of refund and verification of refund process has been expediated and refund for A.Y. 2022-23 has been received by assessee even within 1-2 days after income tax return is processed with refund and intimation u/s 143(1) has been received.

Income Tax Refund awaited for F.Y. 2021-22?

Income Tax Refund awaited for F.Y. 2021-22 ? Follow these steps below to quickly check your status. Income tax refund tracking can be done by following the below steps:

- Log on to e-filing portal of Income tax

- Select e-file menu

- Click on view Filed Returns

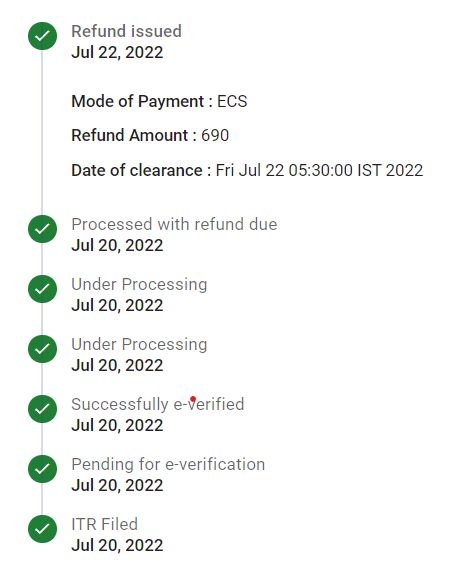

- A window will appear showing the details of date of filing, date of e-verification, intimation status “processed with refund due” in case of refund receivable and last with refund issued date along with mode of payment, refund amount and date of clearance.

Refer image below for understanding the window.

Income Tax Refund awaited but not yet received? How to request for for Refund Re-issue (in case of Income Tax Refund failure)?

Income Tax Refund awaited but not yet received? Refer the steps below to receive refund.

Refund will be issued only in pre-validated bank account of assessee. In case of income tax refund failure, follow the below steps:

- Log on to e-filing portal of Income tax. Refer link >> https://www.incometax.gov.in/iec/foportal

- Go to Services menu.

- Click on Refund Reissue.

- Click on “+ create Refund Reissue request”. (Please note request can be made only in case of refund failures)

- Select the relevant year, pre-validated bank account and click on submit.

- Generate EVC and verify the same.

Things to do if you want an Income Tax Refund fast

Income Tax Refund awaited ? Your misery end here. Follow these simple steps below to get fast Income Tax Refund.

- File return online and e-verify the same. For detail guide on filing of income tax refund read following articles :

- Choose correct form and fill accurate and complete form so that return is processed as is filed.

- Ensure TDS & Self-assessment tax details are appearing in Annual Information Statement (AIS). Please mention correct year in which TDS was deducted.

- File refund reissue request within 1 year after it has been processed.

- Track your refund request timely.

Income tax refund above 50,000

Prior to Mar, 2019 refund above 50,000 were received by means of cheque payment. However, post that any amount of refund is issued through electronic clearing system in pre-validated bank account of assessee.

Income Tax Refund awaited ? Reach out to our experts at TaxLedgerAdvisor

For expert assistance on Income Tax Refund in Udaipur and Rajasthan, reach our professionals at Tax Ledger Advisor.